About GoCardless

GoCardless pricing

GoCardless has a free version and offers a free trial. GoCardless paid version starts at GBP 50.00/month.

Alternatives to GoCardless

GoCardless Reviews

Feature rating

- Industry: Sports

- Company size: 2–10 Employees

- Used Daily for 2+ years

-

Review Source

Easy way to win time

Great, just for little payments the charges update had changed our way to work with that. For the rest, we love it.

Pros

with team-up integration i win so much time. recurrent memberships payments.So easy way to develop payment in our boxes.

Cons

possibility to decrease charges for little payment. 0,20centimes for little payment is so big. in the past we used for so much payment now it's too expensive for little payment. 0,20cent add-on has been living like an horrible news for us.. We need to use stripe now for that.

Reasons for Switching to GoCardless

in the past, little payment great without the 0,20cent add-on and connected with teamup (we use it from 8 years now)- Industry: Human Resources

- Company size: 51–200 Employees

- Used Weekly for 2+ years

-

Review Source

Gocardless - Be able to add a payment choice for your customers

We used Gocardless since 2015, I discovered the product in 2020 and I recommend it because the product is still ramping up, more ergonomic and try to add in France the "instant direct banking" to earn efficacity an security.

Pros

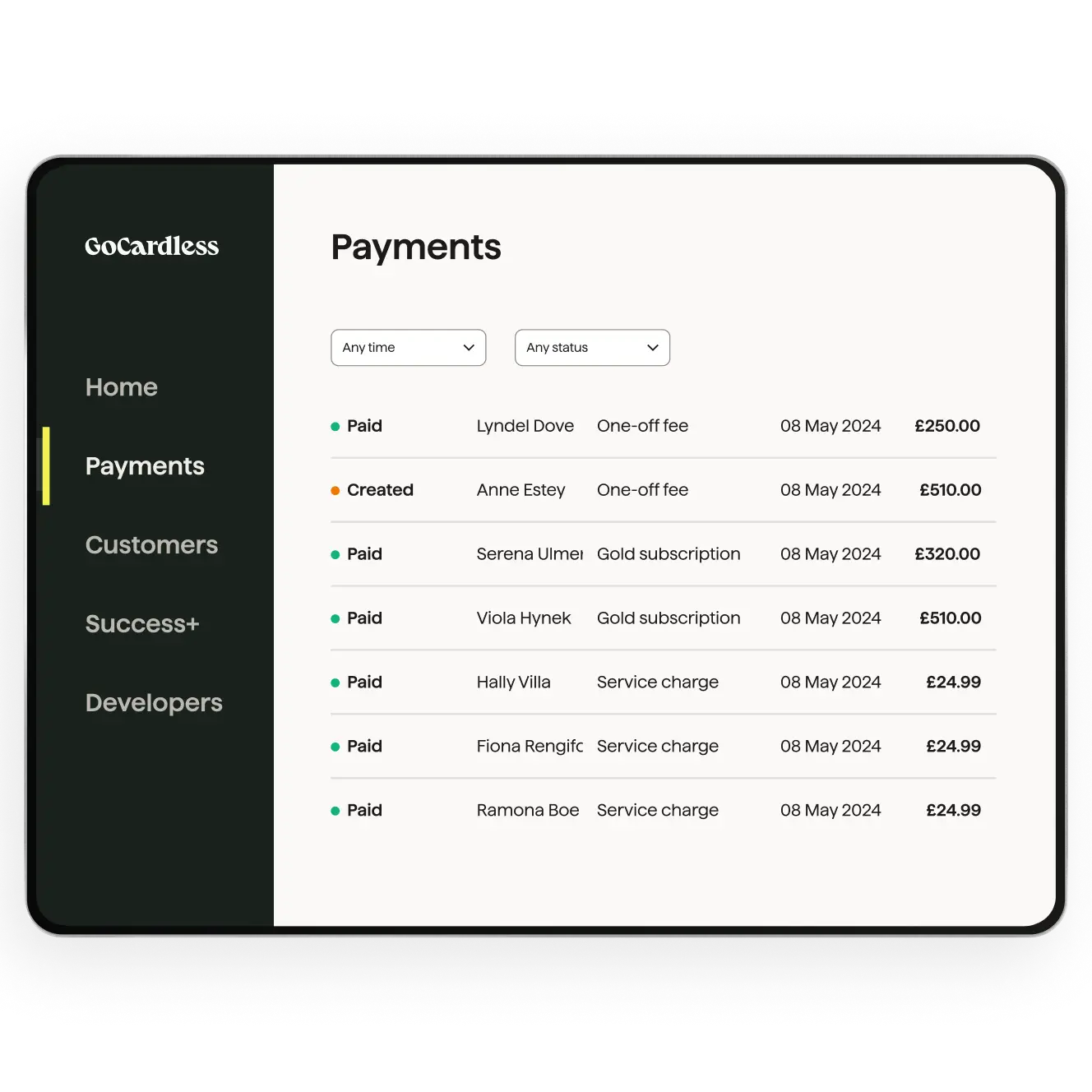

What I like in Gocardless is his reliability, we connected it to our acconting system, ours emails adress, our software and also at our internal communication. It's posible to deal with our reccuring billing but also one time payments. Success+ is also a good product of Gocardless to which automatically restarts failures.

Cons

I'm a little bit of disappointed the time to recover the money between the billing and the money in our bank account. It's between 8 and 14 days.

Reasons for Switching to GoCardless

Their documentation for engineers but also the price and the choice to not be engaged.- Industry: Computer Software

- Company size: 11–50 Employees

- Used Weekly for 1+ year

-

Review Source

Reliable and cheaper alternative to credit card payments

Good, it just works and you can rely on it.

Pros

So much cheaper than credit card payments.

Cons

I would like to integrate it more with my financial system.

- Industry: Financial Services

- Company size: 2–10 Employees

- Used Monthly for 1+ year

-

Review Source

NEVER Use This Service - They are the WORST!

I HATE this business!! They are the absolute worst. They allow you accept payments from customers, and THEN they suspend your account. The "Account Review" team can ONLY be reached by email and then NEVER respond. They have over $40,000 of my funds and have holding my account hostage for over two weeks and counting...

Pros

The provide of their service, which they have broken.

Cons

Everything about actually working with them.

- Industry: Education Management

- Company size: 2–10 Employees

- Used Monthly for 6-12 months

-

Review Source

Minimal Transaction Fees for Reliable Payment Processing

Pros

The minimal transaction fees. This was the only way we were able to afford to start accepting online payments for tuition/fees right off the bat.

Cons

Some of the banking terminology is perhaps unique to Britain, or at least very different from what's commonly used in the U.S., so there's a small learning curve to figuring out how transactions are processing.