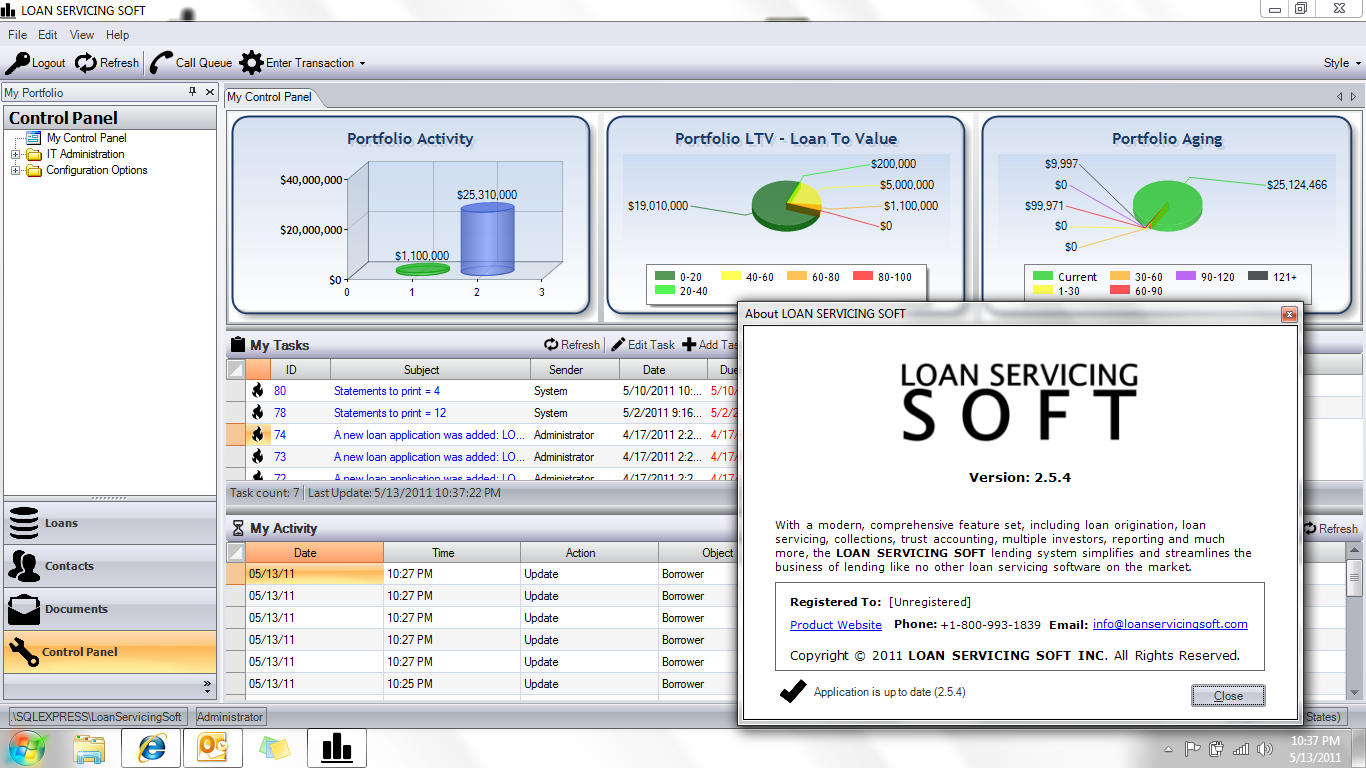

About LOAN SERVICING SOFT

LOAN SERVICING SOFT pricing

LOAN SERVICING SOFT does not have a free version but does offer a free trial. LOAN SERVICING SOFT paid version starts at USD 7,500.00/one-time.

Alternatives to LOAN SERVICING SOFT

LOAN SERVICING SOFT Reviews

Feature rating

- Industry: Nonprofit Organization Management

- Company size: 51–200 Employees

- Used Daily for 2+ years

-

Review Source

Working with LSS

LSS has been a great partner for our organization. They have been very willing to work with us the few issues we've had to the software where we needed it to be to service our clients.

Pros

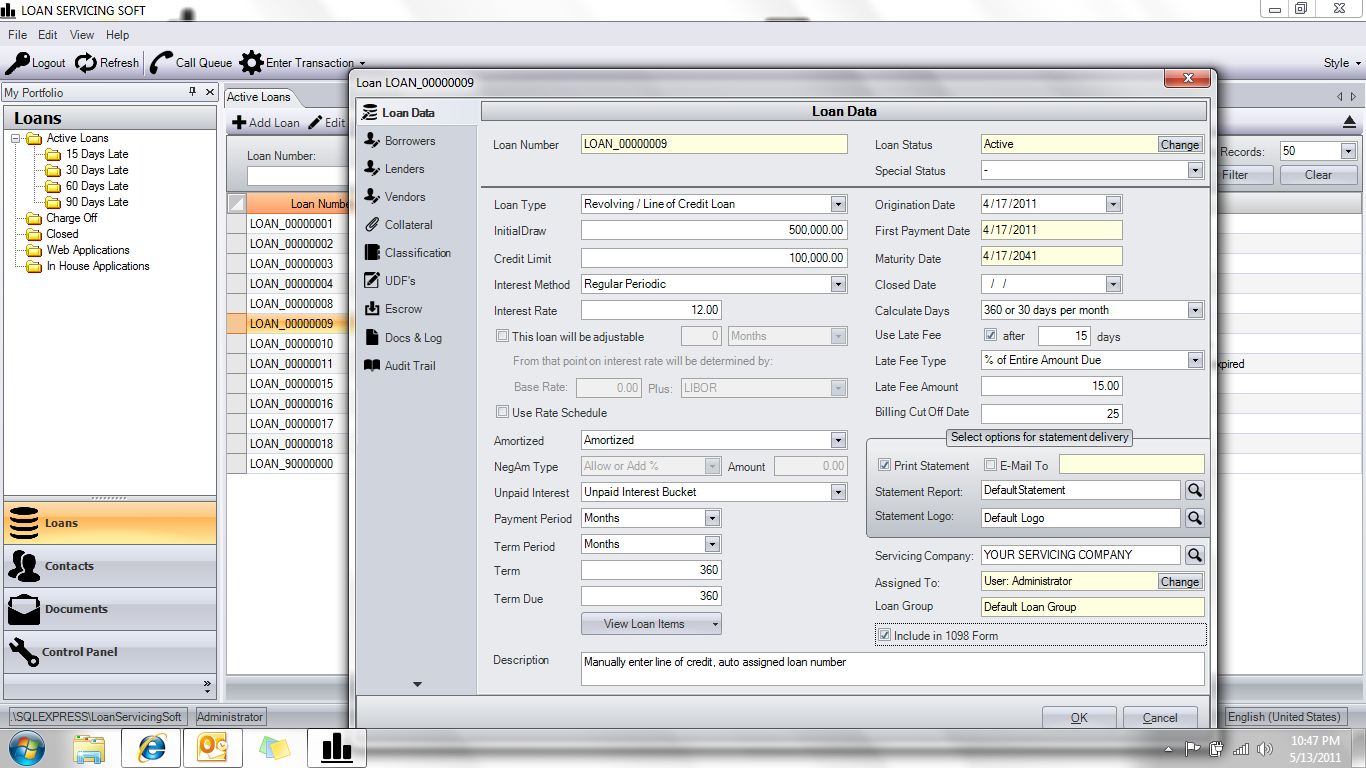

The software is flexible and allows the user add data that is necessary to make decisions.

Cons

Updating the software has to be done on an individual basis and can slow the day down.

-

Review Source

Custom Auto-Decisioning & Servicing Software

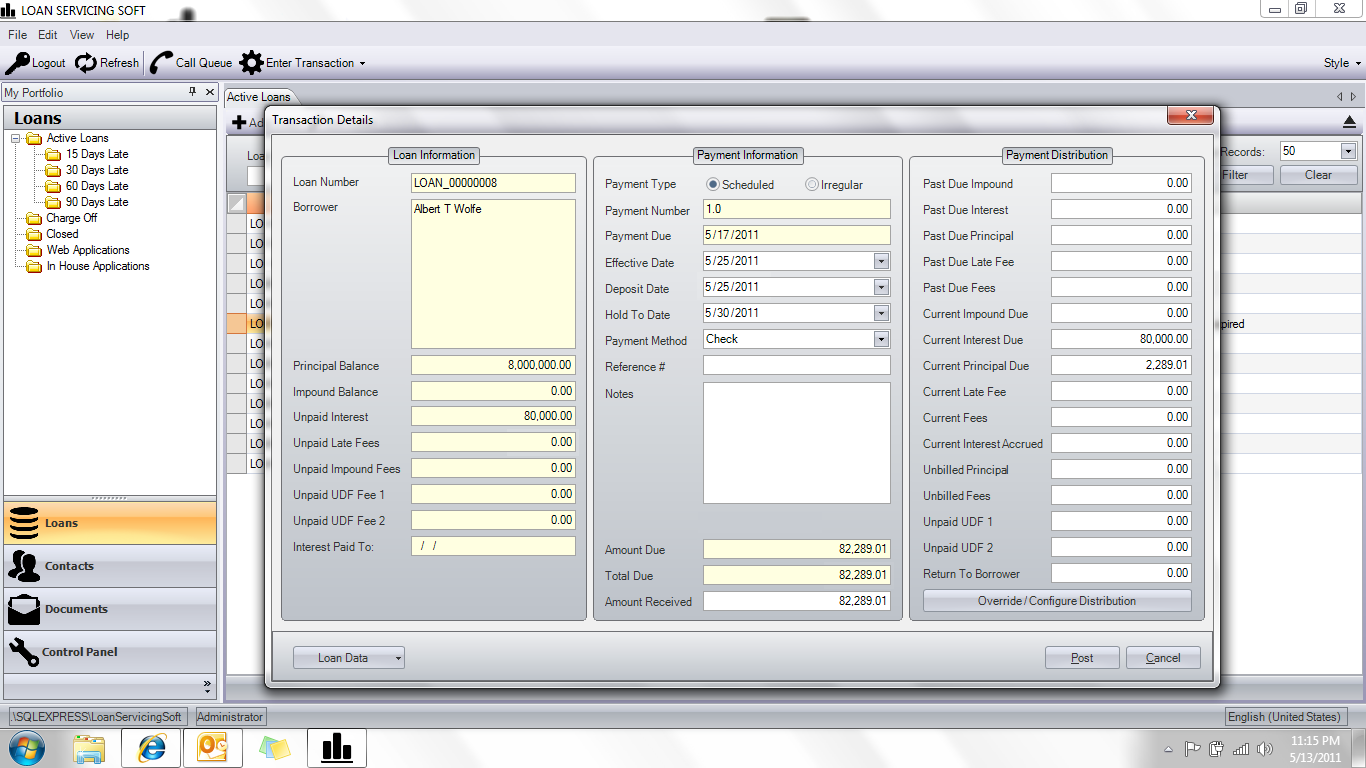

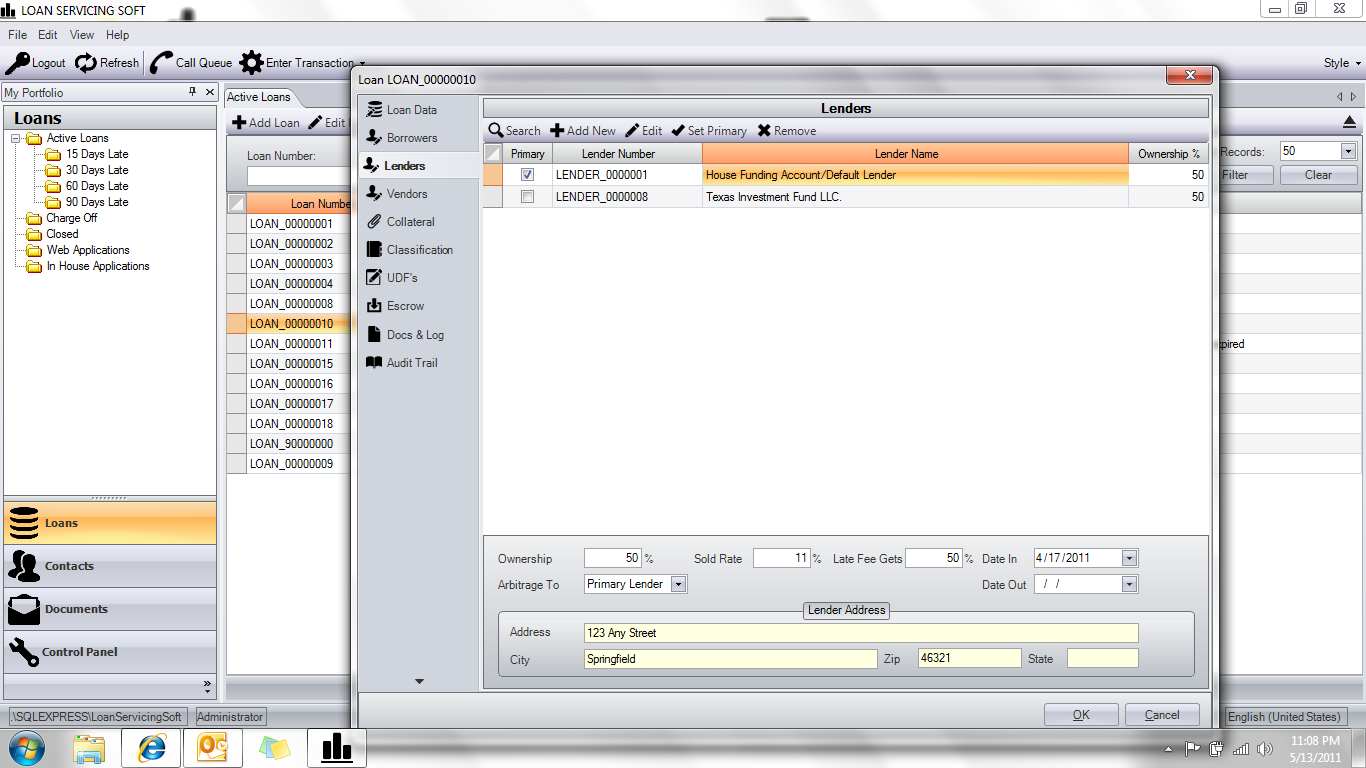

I spent weeks having conference calls with vendors offering loan servicing & loan decisioning software. LSS was the only company that I found that offers both of these platforms in one system. I believe in simplicity. Using 1 system is much better than 2 for originating & servicing your loans. I have done extensive testing on the software & it seems to function very well. It's rare that you find a software company that offers this level of customization. I can't begin to say enough good things about John, he is AMAZING. I have not asked him to do a single task that he was not able to perform. He is a pleasure to work with & takes time answering my questions. He doesn't give up until you're satisfied. I had LSS do things that they have never done with other companies, including writing scripts to increase productivity & parsing data. I really can't wait to see where the development of this software leaves us at the end of the year. They offer import services, which made transferring our old data into the new software a breeze. The process went very smoothly & all the balances/payments were correct. They did offer to show me how to perform the import to save me money, but I preferred peace of mind by ensuring accuracy rather than saving the money for the import. I was very satisfied with the import; the work was flawless. The team really stuck their neck out to meet our launch date & put in the extra hours to meet our investor's deadline, which I really appreciated. I believe there is great value in this software. The price is very fair, because the finished product is built specifically for your business. This is the last software we will ever have to purchase to service & underwrite loans for our company. This software will develop with our business. Proprietary software has cost other companies that I have managed a fortune; you can't imagine how thrilled I am to have such a customized program for a fraction of the cost. Our money was well spent & I highly recommend this software.

- Industry: Banking

- Company size: 11–50 Employees

- Used Daily for 1-5 months

-

Review Source

I wish we'd made the change sooner...

On my previous software I had to keep several different spreadsheets for insurance expiration monitoring, escrow analysis, scheduled future fees etc. All of those functions can be done through LSS eliminating quite a bit of extra work.

Pros

LSS is very customized to our company. It handles every aspect of servicing, insurance information, escrow analysis etc. The customer service support is exceptional. I worked with Rep during setup and training, and he was knowledgeable, patient and pleasant. Learning new software is a big job, but Rep made it the best possible experience. I am very comfortable knowing that our new software has top-notch support.

Cons

We service loans for more than one investor. My investors need reports for their loan portfolios (Sorted by investor/lender). We are customizing reports ourselves, as this is not a standard request. LSS can and will customize reports for a price, but fortunately LSS reports offer the ability to customize yourself if you have the knowledge and ability.

- Used Daily for 1-5 months

-

Review Source

A powerful loan servicing tool with lots of flexibility.

Pros

Great user interface. Enterprise functionality. Customizable. Great user interface. Enterprise functionality. Customizable. Great user interface. Enterprise functionality. Customizable.

Cons

It was hell getting it migrated from NoteSmith. I think we were given the wrong engineer to start. LSS made it right in the end.

-

Review Source

We are a mortgage servicing company and we purchased loan servicing soft

We have 12 employees, we have been using the product for aprox 6 months and we love it. It is user friendly, the service has been great and most of all they respond to our needs immediately. Transitioning from one software program to another in our business is a major feat, but Jeff Tremaine and his techs are absolutely super and have been a great asset to the transition. The best part of the software is the customization. They have accomplished every thing we have asked them to customize without a hitch. If your looking for a mortgage servicing or origination program this is your baby.