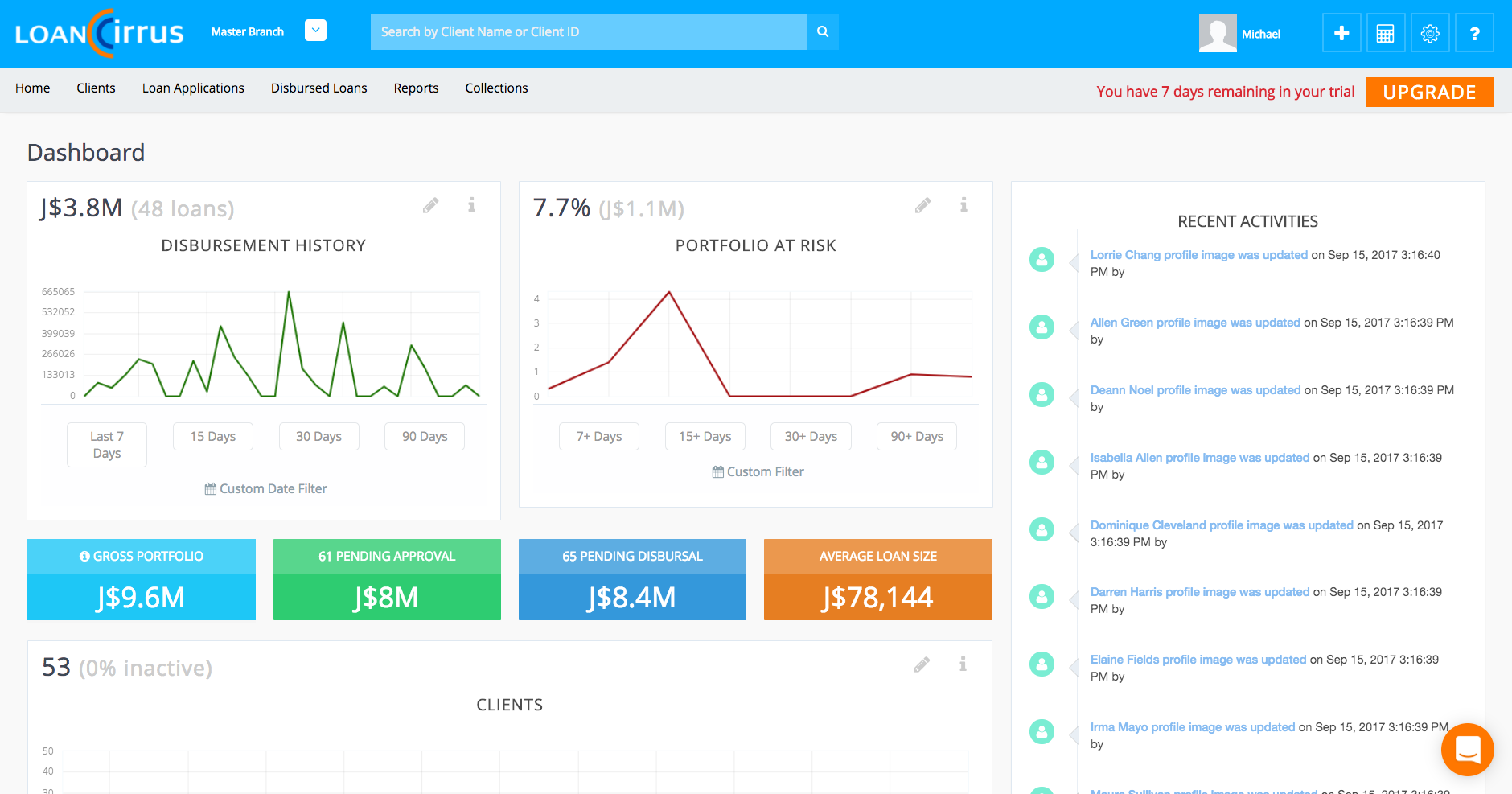

About LoanCirrus

LoanCirrus pricing

LoanCirrus does not have a free version but does offer a free trial. LoanCirrus paid version starts at USD 1,000.00/month.

Alternatives to LoanCirrus

LoanCirrus Reviews

Feature rating

- Industry: Publishing

- Company size: 51–200 Employees

- Used Daily for 1-5 months

-

Review Source

Although the software requires a bit configuration the support team is responsive & knowledgeab...

The confidence to scale my business.

Access to industry relevant information.

Pros

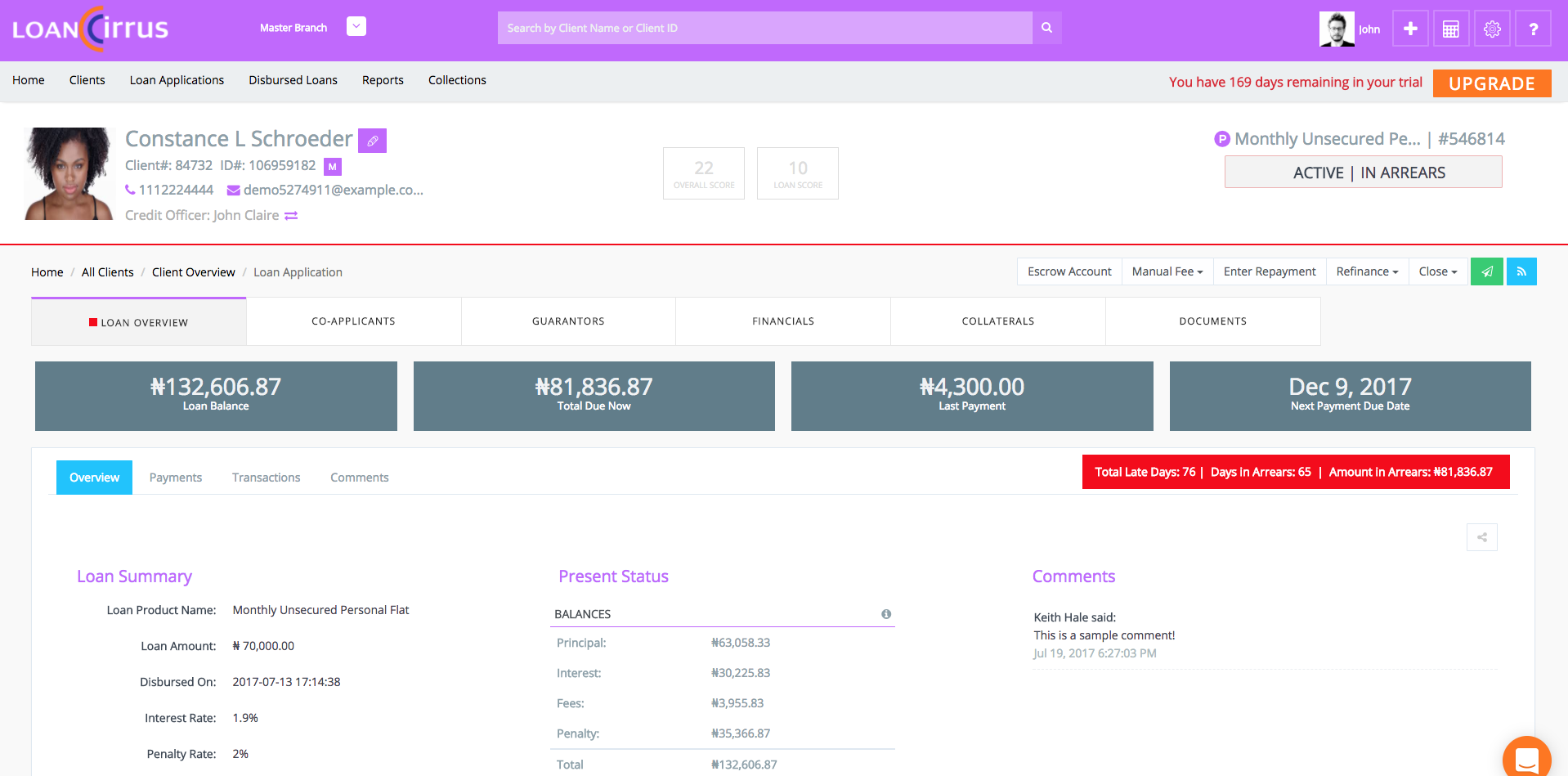

1. I like that the software can be integrated with debt collectors.

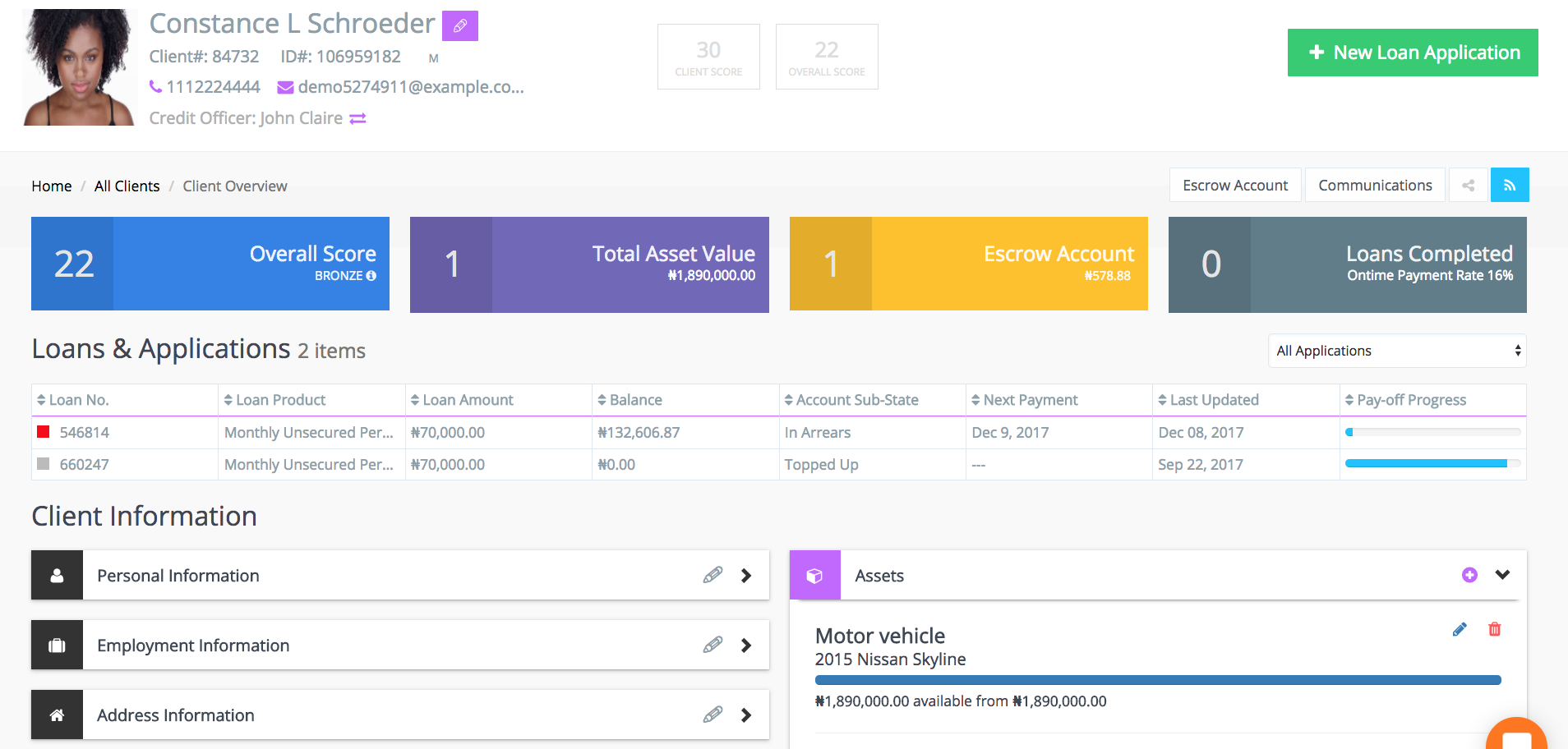

2. I like that I'm able to rate my clients and assess the level of risk they pose based my predetermined criteria.

3. I like that it generates output documents such loan agreements and it also allows me to store my input documents such customer identification and proof of address all in one place.

4. I like that there's a free trial period before having to commit to subscription.

5. LoanCirrus allows me to access the same technology that much larger institutions have access to.

6. LoanCirrus is customizable.

7. The customer support team is always available, very knowledgeable and the turnaround time is impeccable.

8. The team publishes articles on industry trends, standards and how to use the application efficiently.

Cons

LoanCirrus requires a lot of configuration and as such it may take the user some time to get over the learning curve.

- Used Daily for 6-12 months

-

Review Source

It's been an overall good experience so far. It's saved me so much time and money!

Saves money and time.

Pros

I didn't have to hire another employee because it covers so many bases in my business. It fills out application forms so I don't waste paper and I can work from anywhere . It's quick, easy, reliable and the interface is user-friendly. It's made such a positive difference in my business.

Cons

When loan numbers are randomly generated there is no way to identify, based on the number, when the loan was generated; they are not generated in chronological order. That has to be identified by the date that the loan was originated. It's a personal preference, but it would be nice if those numbers could be generated chronologically.

- Industry: Financial Services

- Company size: Self Employed

- Used Daily for Free Trial

-

Review Source

Communication is TERRIBLE. Scheduled appointment. They changed to 3 weeks later. Then no show.

stinks. Very unprofessional of the [sensitive content hidden]. If he's that unprofessional, how can I trust the software is well developed and will be well supported??

Pros

I haven't used it yet. But looks like some good features.

Cons

Communication is TERRIBLE. I scheduled an appointment. It turns out it was with the [sensitive content hidden], as the "sales guy." They changed to 3 weeks later without consulting me. Then I found an email asking me if I was going to show up. I responded, of course. But he responded that he canceled the meeting... after all that waiting to get a demo. They were one of the first Lending CRMs I tried to schedule with. I've met with over a dozen. They were the last ones on my calendar because they canceled and pushed me out 3 weeks. And then they canceled on me because I didn't respond quickly enough to an email asking if I STILL would be at the meeting. OF COURSE, I was. We agreed to it a long time ago. You didn't use an automated calendar tool to keep us connected. All was clear, though very pushed off. You act like it wasn't clear and so cancelled our meeting.

- Used Daily for 6-12 months

-

Review Source

From inception; the Loan Cirrus team has been very helpful with transitioning during our...

Pros

I like the fact that the software is very user friendly and allows users to learn quickly. Also; the software is quite flexible meaning that the developers works well in trying to customize an instance as best as possible to accommodate their customers.

Cons

The least attractive part of Loan Cirrus is probably the fact that there is not one specific person who deals with everything but instead, there is a team of specialists. This is both a pro and a con because this means that they have persons specializing in different areas; however, depending on whether you have the several issues at the same time you'd need to communicate simultaneously.

- Used Daily for 1-5 months

-

Review Source

It made developing our new lending operations extremely easy and cost effective

Pros

We absolutely loved the fact that as a startup, it provided a pricing model that allowed us to get access to a world class software at an extremely affordable price. The application was also fully packed with features and easy to setup. The Customer Success team was always available to help if we ran into any challenges