About @RISK

@RISK pricing

@RISK does not have a free version but does offer a free trial. @RISK paid version starts at USD 2,225.00/year.

Alternatives to @RISK

@RISK Reviews

Feature rating

- Industry: Management Consulting

- Company size: 2–10 Employees

- Used Daily for 6-12 months

-

Review Source

Excellent software for financial risk analysis

It has been really great to understand stochastic processes in finance and analyse investments, mergers and even stocks

Pros

The infinite variety of data representation though excel functions that emulate geometric brownian motion to analyse moving finances

Cons

The UI is pretty bad since there is not a standalone software to write the code and debug

- Industry: Higher Education

- Company size: 501–1,000 Employees

- Used Daily for 2+ years

-

Review Source

Using Monte Carlo Simulation

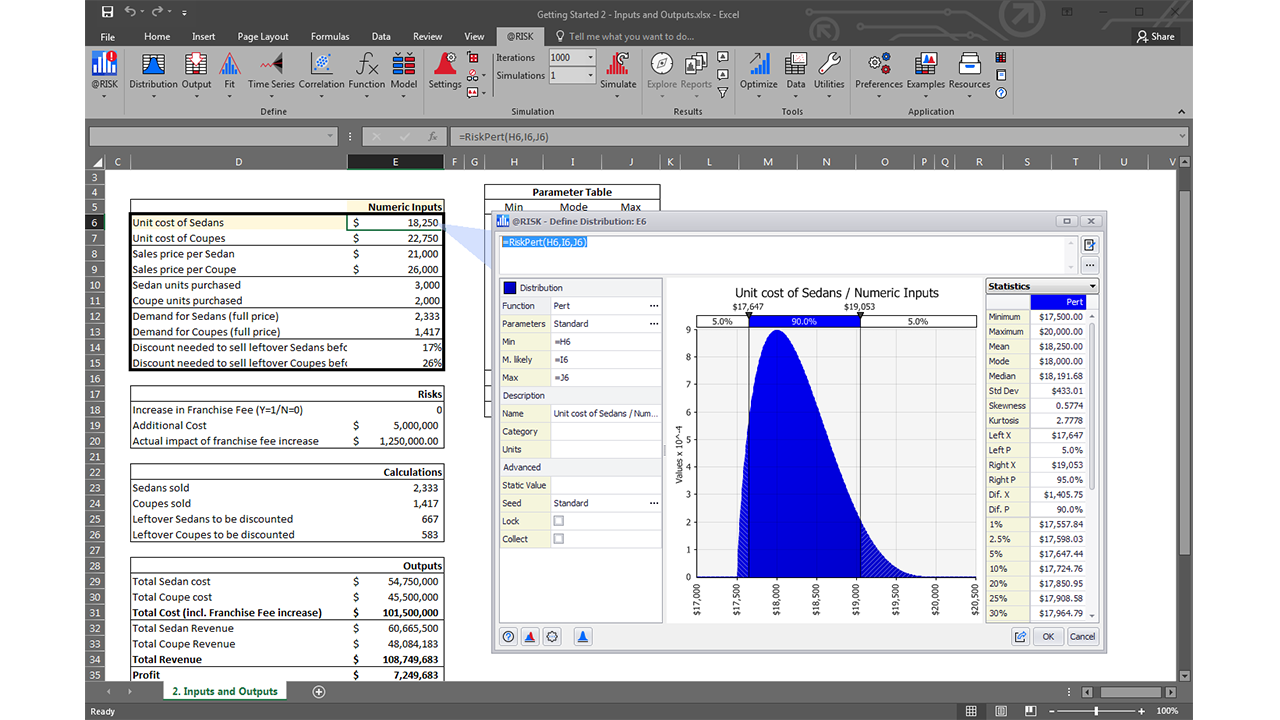

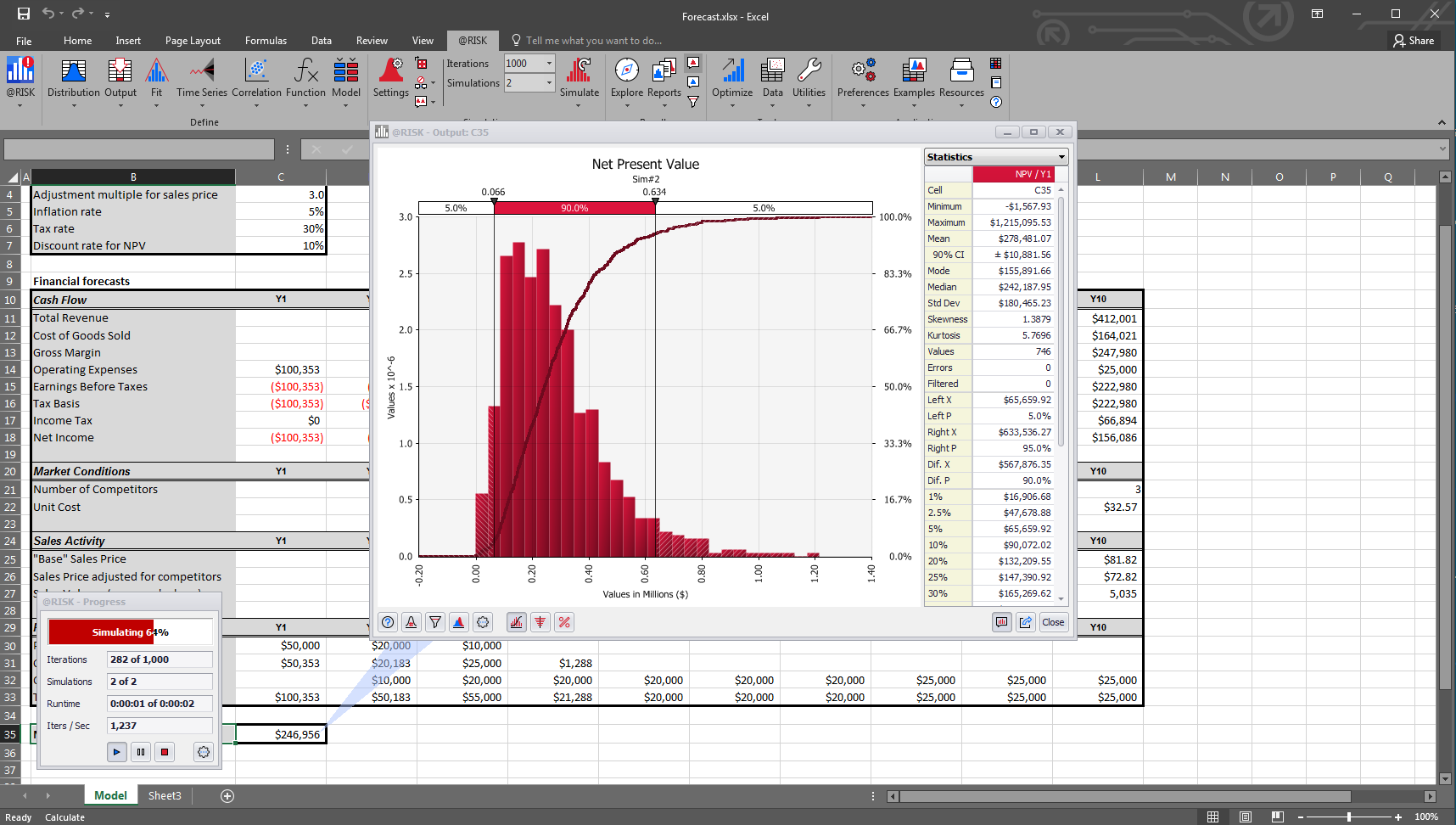

Monte Carlo simulation is a very useful tool that allows the user to incorporate variability to what otherwise would be a simple spreadsheet model that uses average values. It is possible that if you use average values a project you are analysing will be profitable according to your analysis. When you incorporate variability while the expected profit is positive, can find that there is a high probability of the profit being really a loss.

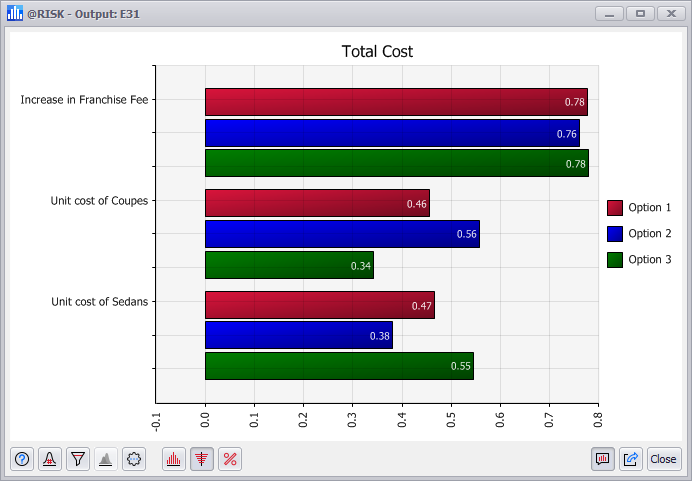

@risk is a software you can use to create this type of models. It is basically an Excel add-in that will allow you to transform your Excel model into a much more versatile one. When you run your model you obtain not only a point estimate but can look the spread of the estimates. Can also identify which input variables are critical and you can also do some sensitivity analysis to look into the potential effect of one or more of the inputs changing (for example, what could happen if interest rates change).

The software is easy to use and it has an excellent manual as well as excellent online support. The company also organises on a regular basis very interesting conferences where case studies are presented by companies and these conferences are an opportunity to meet like minded people.

I have been using the software mostly for teaching but past students are using them at their workplace with great success.

Pros

Two things: documentation and the easiness to do networking which is very important for anybody who is interested on working in the area.

Cons

Would like to see more practical examples of BIG projects but I suppose many of them are property of the company that developed them.

Response from Lumivero

Thank you, Alicia, for taking the time to write this glowing review of our software! We are so appreciative of customers, like yourself, that spread the word about @RISK and Monte Carlo simulation. Your description of Monte Carlo simulation is perfect and helps to demystify it for those that aren't familiar with why Monte Carlo simulation can often times be a better option.

We have over 80,000 students a year using our software, some of which are probably your students! These students will typically enter the workforce being able to make better decisions using @RISK and Monte Carlo simulation.

Thank you, again, for your kind words and for being one of our valued users!

- Industry: Biotechnology

- Company size: 2–10 Employees

- Used Monthly for 1+ year

-

Review Source

OK product - super scammy company - watch out - auto renewal with no notice and no refund

Decent product - but dangerous company to be involved with.

Pros

Ok product. Useful for what it does. Integrates well to excel. The problem is the software vendor - not the product.

Cons

The company basically makes money like a gym membership. Hope that people forget to cancel and dont offer refunds. Customer service emails bounce. We stopped using the product and got hit with a 6k auto renewal charge. We called the day of to cancel and they told us our contract said we could only cancel 60 days prior to renewal. Huge red flag. No way to use the product without signing the auto renewal agreement and they dont send notifications prior to auto renewal.

- Industry: Insurance

- Company size: 1,001–5,000 Employees

- Used Daily for 2+ years

-

Review Source

Just okay - R or Python better

Pros

The software integrates very easily with excel, and for an advanced user of excel, it is really easy to get the hang of. @Risk functions make it easy to calculate distributions.

Cons

@Risk is very slow when making complicated models or dealing with large datasets. R or Python would be able to process much quicker.

- Industry: Education Management

- Company size: 1,001–5,000 Employees

- Used Monthly for 1+ year

-

Review Source

One of the best tool for financial risk analysis

Pros

Good for running simulations, predicting the risk, and easy to use.

Cons

No mobile access and its UX/UI could be better.